Relevance: GS-3 (Indian Economy – Monetary Policy); Source: The Hindu, RBI MPC briefing

The Reserve Bank of India announced large-scale Open Market Operation (OMO) purchases of government securities worth ₹1 lakh crore to inject durable liquidity into the banking system, along with a USD/INR buy-sell swap to ease liquidity pressures.

Key Concepts

- Government Securities (G-Secs):

Tradable debt instruments issued by the Union Government, considered risk-free. They include dated securities and Treasury Bills. - Open Market Operations (OMO):

Monetary policy tool where RBI buys or sells G-Secs to regulate liquidity.

- RBI buying G-Secs → injects liquidity

- RBI selling G-Secs → absorbs liquidity

- Forex Swap (USD/INR Buy-Sell): A liquidity tool where RBI buys dollars now and commits to sell later, temporarily affecting rupee liquidity without targeting the exchange rate.

Impact on the Economy

- Injects durable liquidity into banks → improves credit flow.

- Helps manage volatility in bond yields.

- Supports smoother monetary transmission.

- RBI clarifies market determines rupee’s value; the step is for liquidity, not exchange-rate support.

Q. Consider the following statements:

- When RBI conducts OMO purchases, the liquidity in the banking system decreases.

- Government securities issued by the Union Government carry no credit risk.

- A buy-sell USD/INR swap by RBI is used to stabilise the rupee’s exchange rate.

Which of the above statements is/are correct?

A. 2 only

B. 1 and 3 only

C. 2 and 3 only

D. 1, 2 and 3

Correct Answer: A (2 only)

Share This Story, Choose Your Platform!

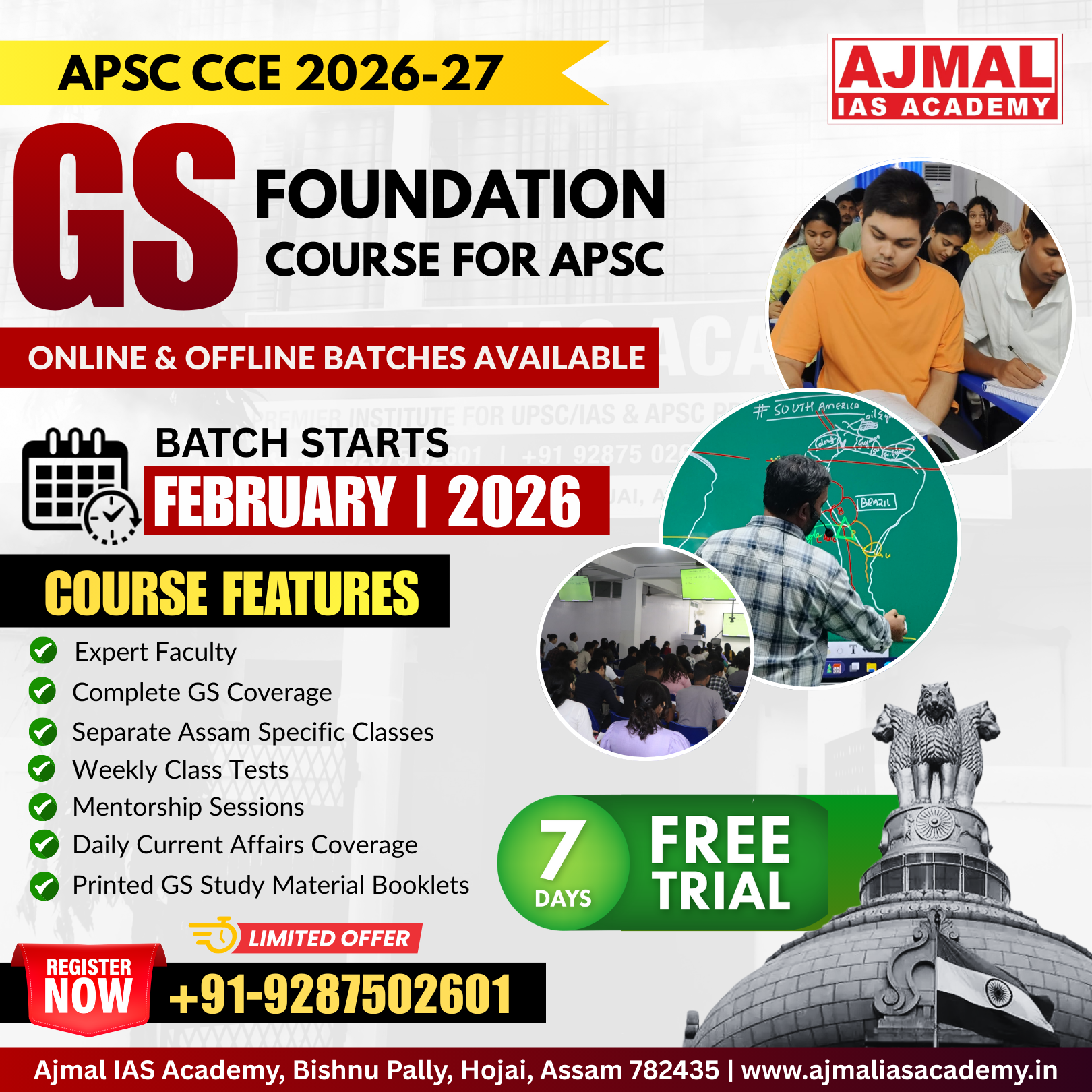

Start Yours at Ajmal IAS – with Mentorship StrategyDisciplineClarityResults that Drives Success

Your dream deserves this moment — begin it here.