Relevance: Governance, Federalism, Local Bodies (GS-II)

Source: The Hindu ; Reports of the 16th Finance Commission

Context

The 16th Finance Commission (2026–31) has submitted its report to the President. A key expectation is how it will strengthen panchayats and municipalities, which are responsible for essential public services but struggle with weak revenues and heavy dependence on higher governments.

Local Bodies in India –

A. Constitutional Status

Tier | Based On | Key Articles | Powers |

| Panchayats (Rural) | 73rd Amendment (1992) | 243–243O | Local planning, basic services, property tax (limited), sanitation |

| Municipalities (Urban) | 74th Amendment (1992) | 243P–243ZG | Urban planning, water supply, public health, mobility, property tax |

Role of Central and State Finance Commissions in Financing Panchayats

Dimension / Pillar | Union Finance Commission (16th FC) | State Finance Commissions (SFCs) |

| Constitutional Basis | Article 280 of the Constitution of India | Articles 243-I (Panchayats) and 243-Y (Municipalities) |

| Constitutional Status | Constitutional body for inter-governmental fiscal transfers (Union → States) | Constitutional body for intra-State fiscal devolution (State → Local Bodies) |

| Appointed By | President of India (quinquennial—every five years) | Governor of the State (quinquennial—every five years) |

| Primary Mandate (As per Article 280) | • Recommend vertical devolution of divisible pool taxes from Union to States • Recommend horizontal distribution among States based on objective criteria • Recommend grants-in-aid under Article 275 • Recommend grants for Panchayats and Municipalities (Arts. 243-I & 243-Y read with 280(3)) • Recommend measures to enhance the Consolidated Fund of India / fiscal consolidation | • Recommend principles for distribution of State revenues between the State and local bodies • Identify and assign taxation powers (property tax, fees, cesses) to Panchayats & Municipalities • Recommend grants-in-aid from the Consolidated Fund of the State • Lay down expenditure norms and fiscal accountability mechanisms |

| Local Body Coverage | National coverage: evaluates needs of ~2.7 lakh Panchayats and ~5,000 Urban Local Bodies | All local bodies within the State (PRIs under Part IX, ULBs under Part IX-A) |

| Role in Local Finance | • Provides predictable, formula-based, non-discretionary transfers to local bodies • Sets national fiscal standards for PRIs and ULBs • Incentivises compliance with audits, transparency, own-revenue mobilisation | • Determines State-level devolution formula • Advises on strengthening the Consolidated Fund of the State → PRIs/ULBs transfers • Calibrates local revenue powers and expenditure responsibilities |

| Implementation Status | Recommendations generally implemented by Parliament and become basis for Union → State transfers | Weak record: Many States delay constitution, delay report submission, or do not implement recommendations; only ~6 cycles in 30 years |

| Role in Fiscal Decentralisation | Anchors cooperative federalism, strengthens Union–State fiscal architecture | Critical for grassroots fiscal autonomy, operationalises the 73rd & 74th Amendments, but weak compliance undermines decentralisation |

| Overall Impact | Ensures stable intergovernmental fiscal transfers, enabling States and local bodies to plan effectively | Should ensure stable State → Local Body fiscal flows but often fails due to irregular constitution, delayed reports, and poor implementation |

What Can Local Bodies Expect from the 16th FC?

a) Predictable, formula-based grants

The FC is expected to recommend: Basic grants; Performance grants (sanitation, water quality, digitisation, auditing) and Incentives for States that empower local bodies

b) Greater focus on municipal finance

Urbanisation demands stronger city finances. The FC may support: Property tax reforms; User charges for services; Support for climate-resilient infrastructure

c) Support for panchayat service delivery

Funds may help panchayats improve: Drinking water; Sanitation; Rural roads; Public health & community assets

d) Emphasis on transparency & audits

Given past misuse, stricter norms for: Social audits; Online accounting; Timely utilisation certificates.

Local Bodies: Challenges and Way Ahead

Dimension | Key Challenges | Way Ahead / Required Reforms |

| Fiscal Capacity | • Large revenue–expenditure gap • Weak own-source revenues (property tax efficiency often < 40%) | • Diversified revenue sources – land value capture, user charges, municipal bonds • Improve property tax administration & GIS mapping |

| Institutional Framework | • Delayed SFCs, irregular cycles, and weak implementation | • Regular, empowered SFCs with statutory timelines for constitution & action-taken reports |

| Financial Governance | • High dependence on scheme-based tied funds rather than untied grants | • Digitisation of local finances, real-time audits, transparent budgeting |

| Administrative Capacity | • Fragmented, understaffed and low-skilled municipal workforce | • Professionalisation of municipal cadres; dedicated urban services recruitment |

| Intergovernmental Coordination | • Centre–State overlap in schemes; duplication of functions | • Clearer Centre–State–Local coordination, functional demarcation under 73rd/74th Amendments |

Local governments must be treated not as spending agencies but as true third-tier governments. Empowered local bodies require empowered finances, and the 16th FC is a major opportunity to achieve this.

UPSC Mains Question

“Finance Commissions and State Finance Commissions together form the backbone of fiscal decentralisation. Discuss how the 16th Finance Commission can strengthen local governance in India.”

Share This Story, Choose Your Platform!

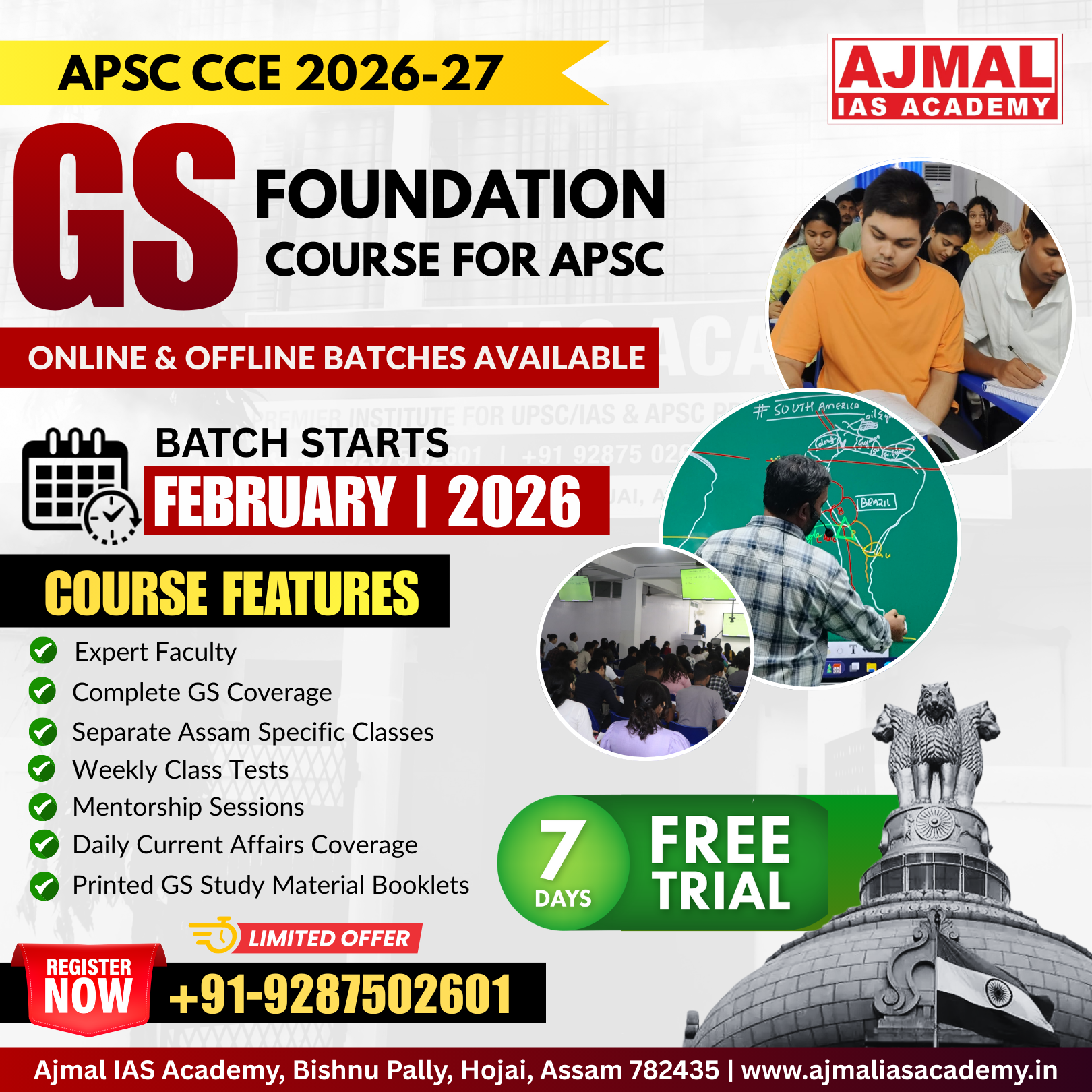

Start Yours at Ajmal IAS – with Mentorship StrategyDisciplineClarityResults that Drives Success

Your dream deserves this moment — begin it here.