Relevance: GS III (Internal Security, Money Laundering, Economy); Source: The Hindu / FIU-IND Guidelines (Jan 2026)

Context

To align with global FATF standards, the Financial Intelligence Unit (FIU-IND) issued updated January 2026 guidelines for Virtual Digital Asset (VDA) Service Providers. These norms mandate strict “Liveness Detection” and bank verification to curb money laundering and terror financing.

Key Regulatory Mandates (2026 Guidelines)

- ‘Penny-Drop’ Verification: Exchanges must deposit a nominal amount (e.g., ₹1) into the user’s bank account.

- Purpose: To confirm the account is active and belongs to the actual user (preventing use of “mule” accounts).

- Liveness Detection: Users must upload a real-time “live” selfie during onboarding.

- Purpose: Filters out deepfakes, bots, and stolen static photos.

- Geo-Fencing: Recording GPS coordinates and IP addresses is now mandatory to track suspicious cross-border flows.

- Red Flags: The use of ‘Mixers’ and ‘Tumblers’ (tools that obscure transaction trails) is strictly flagged as high-risk.

Why It Matters

- Travel Rule Compliance: Ensures India meets FATF (Financial Action Task Force) requirements to share originator/beneficiary details for crypto transfers.

- Surveillance Model: India maintains a “Regulate via Monitoring” stance—imposing banking-grade compliance without granting crypto legal tender status.

UPSC Value Box

| Term | Relevance for Prelims |

| FIU-IND | Financial Intelligence Unit – India. The national nodal agency for processing financial intelligence. Operates under the Ministry of Finance. |

| Reporting Entity | Crypto exchanges are legally “Reporting Entities” under the PMLA, 2002. They must file Suspicious Transaction Reports (STRs). |

| Virtual Digital Asset | Defined in Finance Act, 2022. Includes cryptocurrencies and NFTs. Taxed at 30% (Flat) + 1% TDS. |

- With reference to the regulation of Virtual Digital Assets (VDAs) in India, consider the following statements:

- The Financial Intelligence Unit (FIU-IND) is the nodal agency for regulating crypto exchanges under the Prevention of Money Laundering Act (PMLA).

- ‘Penny-drop’ verification is a mechanism used to anonymize the identity of the user for privacy protection.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Correct Answer: (a)

Share This Story, Choose Your Platform!

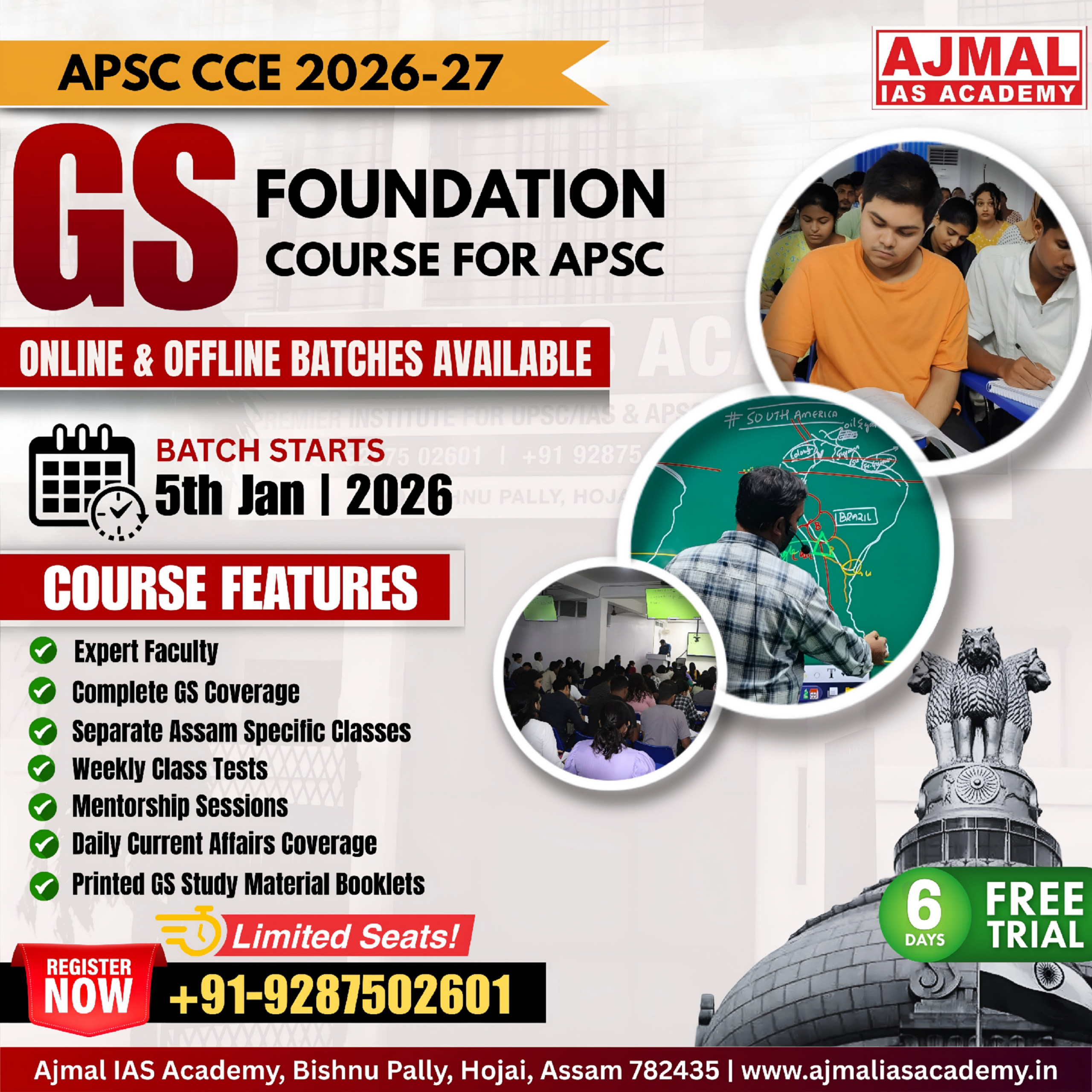

Start Yours at Ajmal IAS – with Mentorship StrategyDisciplineClarityResults that Drives Success

Your dream deserves this moment — begin it here.