India’s rule of aiming for 4% Consumer Price Index inflation with a 2–6% range has mostly done what it promised—cool down price rises and steady people’s expectations. Former Monetary Policy Committee members want this rule to continue. The real work ahead is to handle food price swings better, improve how interest-rate changes reach borrowers and savers, and protect growth and jobs, especially for the poor.

Syllabus : GS 3(Indian Economy, Inflation)

What changed

Inflation has come down from the high points of the last few years. Growth is still solid, helped by construction, travel, trade, finance and other services. But food prices keep jumping when weather, storage, transport, or global markets misbehave. The Reserve Bank is reviewing the framework that began in 2016 and was renewed in 2021 (in force till 2026). The core question is practical: should India change the target or band, or keep them and upgrade the day-to-day tools that deal with food and other shocks?

- Recent pattern: When prices ran hot, policy rates were raised to cool demand. As pressure eased, the central bank paused to let the economy breathe. This shows the rule can be firm when needed and flexible when shocks fade.

- Where it hurts: Food—vegetables, cereals, pulses—can move the headline number by a lot in a single month. These are often supply problems, not demand problems; raising rates cannot grow tomatoes or build cold stores.

- Why the review matters: A clear, stable rule shapes how banks price loans, how firms plan costs, and how workers bargain for wages. If the goalpost itself keeps moving, people lose trust and pricing becomes noisy again.

How the system works

At the heart of the framework is a simple deal: the elected government sets a clear inflation goal; the central bank moves the policy interest rate so that overall demand and borrowing costs guide inflation back toward the goal over time. This setup gives everyone—families, firms, and banks—a common anchor.

Key ideas in everyday words

- Consumer Price Index: A basket of common purchases—food, fuel, housing, clothing, travel, health, education, and many services. Because food is a large share of the Indian basket, food shocks move the index quickly.

- Inflation targeting: India aims for 4% inflation, with a tolerance band of 2–6%. The band accepts that shocks happen but keeps a hard outer fence.

- Flexible, not rigid: The central bank may look through a short-lived onion or tomato spike, so long as inflation is guided back toward 4% within a reasonable time.

- Anchored expectations: When people trust that prices will average near the goal, they do not pre-emptively raise wages or product prices, which itself makes inflation easier to control.

Monetary Policy Committee — who and what

- Who sits on it: Six members—three from the Reserve Bank (including the Governor) and three external economists chosen by the government for fixed terms.

- What it does: Meets six times a year to decide the policy rate and the overall stance. Each member has one vote; if there is a tie, the Governor has a casting vote.

- What it publishes: A resolution on the day of the decision, and minutes with each member’s reasoning after a short gap. This makes the process transparent.

- Accountability rule: If inflation stays outside the 2–6% range for three straight quarters, the Reserve Bank must write to the government explaining the reasons, the action plan, and the time needed to return to the goal.

Why this design helps: The rule and the committee turn a fuzzy job into a clear public contract. Everyone can see the goal, the actions, and the explanations.

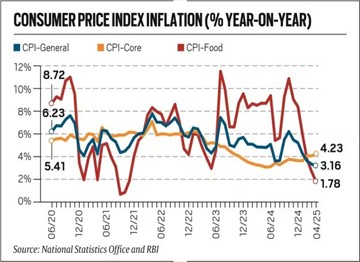

What the numbers say

After a phase of high inflation driven by supply disruptions and global shocks, headline inflation has eased. The cool-down has been uneven: food is still jumpy, while core prices—which leave out food and fuel—have softened, showing weaker broad pressure. Growth has stayed resilient, with construction and services doing most of the lifting, and manufacturing improving but not equally across all sub-sectors. Credit to households and businesses has grown, though earlier rate hikes did raise monthly payments for new loans.

- Headline inflation: Lower on average than a year ago, but still spike-prone when weather or imports misfire. Short spikes fade; deeper food shortages take longer to mend.

- Core inflation: Trending down, which is a sign that general price setting is calmer than before.

- Growth pulse: Steady. Public investment and housing have helped; travel and trade have normalised; factories are gaining but remain patchy in some industries.

- Policy reading: The framework has mostly worked as intended—tighten when necessary, pause when cooling is visible—without crushing activity.

Keep the rule, or change it?

Why many experts want continuity

- Do not move the goalposts: A familiar target with a known band anchors behaviour. Changing the number risks confusion just when expectations are settling.

- Food shocks need food tools: Interest rates cannot fix crop failure or poor storage. The smarter fix is better food management, not a higher or looser target.

- Built-in discipline exists: The “write-to-government” clause forces action if inflation strays for too long; there is already pressure to correct.

Fair concerns to address (they support improvement, not scrapping)

- Frequent food spikes: If messages are unclear, people may start doubting the target and raise wages or prices in advance.

- Weak pass-through: Policy rate moves do not always reach home loans, small-business loans, or deposits fully or on time.

- Patchy data: Quick, reliable numbers on sowing, stocks, mandi prices, arrivals, and trade flows are still not available in one place and in real time.

Bottom line: Keep the rule. Upgrade the plumbing around food, finance, and information.

Who gains most from low, stable inflation

Low and predictable inflation is the best shield for the poor. A large part of a low-income household’s budget goes to food and transport. Even a small jump in prices cuts the real value of wages right away. For senior citizens and small savers, stable inflation protects the purchasing power of deposits and pensions. For small firms, steady prices mean cleaner contracts, fewer disputes, and better planning of inventory and wages. For workers, calmer price trends reduce the need for sudden wage bargaining, which helps preserve jobs.

- Protects daily consumption: Essentials remain within reach; fewer forced cuts in nutrition or schooling.

- Limits debt traps: When prices are not racing ahead, families borrow less just to keep up with basics.

- Helps business confidence: Input costs change less wildly; firms can plan production and hire with more certainty.

Challenges to fix

- Food volatility: Weather shocks, pests, storage losses, transport bottlenecks, and sudden export or import changes whipsaw prices of vegetables, cereals, and pulses. The result is a headline number that jumps sharply even when the broader economy is calm.

- Transmission gaps: Banks may be slow to change lending and deposit rates. Fixed costs, risk concerns, and delayed benchmark resets can weaken or delay the effect of policy moves.

- Communication risk: When inflation spikes, people may fear a return to high inflation if the central bank does not explain the shock, its expected life, and the path back to the goal in plain words.

- Coordination gaps: Food stock releases, import timing, taxes on fuel, and other government actions must align with the inflation goal. If they clash, monetary policy has to work harder and growth suffers more than needed.

- Household protection: Many small savers lack simple, trusted ways to protect savings from inflation; many borrowers face payment shock when rates rise because they are on floating loans with little choice.

- Data and delivery: Market information, crop updates, and trade flows are scattered across departments. Without timely dashboards, action is slow and often too late.

Way Forward — Keep the Rule, Sharpen the Tools

1. Food-Price Playbook (Early Warnings, Predictable Actions, Less Waste)

-

Public, time-bound plan: Move from ad-hoc firefighting to pre-announced steps when risk signals flash; this helps both farmers and consumers.

-

Early alerts: Use weather patterns, sowing reports, and mandi arrivals to flag risks for pulses, onions, tomatoes, and edible oils.

-

Time-bound imports & buffer releases: Announce quantity and timing in advance to cool panic; spread releases to avoid gluts.

-

Storage and cold chains: Invest in pack-houses, ripening rooms, and reefer transport so perishables survive the journey from farm to city.

-

Smoother trade rules: Use tariff bands that adjust within known limits; avoid sudden export bans that break farmer trust and delay next season’s planting.

-

State-level action: Strengthen local markets, grading systems, and e-trading so supply flows faster during shortages.

2. Stronger Transmission and Safer Finance (Make Rate Moves Matter on the Ground)

-

Faster pass-through: Ensure quicker resets in benchmark-linked loans; improve the link between policy rates and small-saver returns.

-

Rate-shock buffers: Encourage longer fixed-rate loans for homes and small businesses so monthly payments don’t jump overnight.

-

Cleaner balance sheets: Speed up stress recognition and resolution; healthier banks can transmit policy better and price credit fairly.

-

Simple saver protection: Offer inflation-linked or laddered savings options so households can safeguard small nest eggs.

3. Clear, Frequent, Plain-Language Communication (Build Trust)

-

Explain the driver: Break down inflation into food vs. broad pressures and explain clearly which one is rising and why.

-

Give a dated path back: When inflation breaches the range, lay out a timeline and policy mix to return to the 4% target.

-

Publish dashboards: Release nowcasts, food-risk meters, buffer stock positions, and import calendars—simple, one-page, easy to read.

4. Tighter Discipline, Lighter Paperwork (Focus on Outcomes)

-

When the range is breached: Publish a time-bound plan and review progress openly at each policy meeting.

-

Cut red tape for firms: Avoid turning inflation control into extra paperwork. Focus on measurable outcomes, not more forms.

Exam Hook

Key takeaways

- The 4% goal with a 2–6% range has anchored expectations; keep it.

- The main upgrades are better food management, stronger pass-through to loans and deposits, cleaner bank balance sheets, and clearer messages.

- Low, stable inflation helps the poor first, protects small savers, and lets small firms plan with confidence.

Mains Question

Q. India follows a flexible CPI inflation target of 4% with a 2–6% range. In the ongoing review, should the framework change? Discuss.

Hints to consider in your answer:

- Monetary Policy Committee (MPC): role in setting repo rate, accountability, balancing growth vs inflation.

- Food shocks: repeated supply-side spikes (vegetables, pulses) that dominate CPI basket.

- Impact on poor households & small firms: food inflation, higher borrowing costs, stress on working capital.

- Policy coordination: monetary policy + supply-side actions (buffer stocks, imports, logistics).

- Way forward: better food-price management, improved inflation data, realistic target band, transparency in MPC reviews.

One-line wrap

Keep the rule, fix the plumbing: hold the 4% target, manage food swings smarter, and make rate changes bite on the ground—so prices stay steady, growth stays steady, and the poor stay protected.

Share This Story, Choose Your Platform!

Start Yours at Ajmal IAS – with Mentorship StrategyDisciplineClarityResults that Drives Success

Your dream deserves this moment — begin it here.