Syllabus: GS-II & V — Centre–State Relations

Why in the News

On October 1, 2025, the Union Government released an additional ₹1,01,603 crore to all state governments as part of tax devolution, over and above the regular monthly instalment due on October 10.

The Ministry of Finance stated that the move aimed to help states accelerate capital expenditure and welfare spending during the festive season.

More About the News

Among Northeastern states, Assam received the highest share (₹3,178 crore), followed by Arunachal Pradesh (₹1,785 crore) and Meghalaya (₹779 crore).

In total, the eight Northeastern states received ₹8,668 crore (8.5%) of the total amount, while major states like Uttar Pradesh (₹18,227 crore) and Bihar (₹10,219 crore) topped the list.

What is Tax Devolution?

Objective:

Tax devolution is the transfer of a share of the Centre’s tax revenue to states to ensure:

– Fiscal balance between Union and states,

– Financial autonomy for states, and

– Equitable distribution for balanced regional development.

Constitutional Basis:

Governed by Articles 270 and 280 of the Constitution.

– The Finance Commission recommends the distribution of net tax proceeds between Centre and states (vertical) and among states (horizontal).

– The Union Government implements these recommendations.

– The current pattern follows the 15th Finance Commission (2021–26).

Formula for Tax Devolution (15th Finance Commission)

| Criteria | Weight (%) |

|---|---|

| Income Distance | 45 |

| Population (2011 Census) | 15 |

| Area | 15 |

| Forest & Ecology | 10 |

| Demographic Performance | 12.5 |

| Tax Effort | 2.5 |

Key Recommendation: States’ share in the divisible pool fixed at 41% (down from 42% under 14th FC due to J&K bifurcation).

What is Additional Tax Devolution?

An extra instalment of funds released outside the regular monthly schedule.

Helps states manage liquidity, speed up developmental works, and boost capital spending during critical times (festive seasons, economic slowdowns).

In FY 2025–26, ₹1,01,603 crore was released in October—doubling fiscal support to states for the month.

Constitutional Provisions Related to Centre–State Financial Relations

| Article | Provision |

|---|---|

| 268–269 | Duties levied by the Centre but collected by States |

| 270 | Taxes levied and collected by the Centre but shared with States |

| 275 | Grants-in-aid to States in need of assistance |

| 280 | Establishment and functions of the Finance Commission |

| 282 | Allows both Centre and States to make grants for public purposes |

These articles form the backbone of India’s fiscal federalism—balancing central revenues and state expenditure responsibilities.

Current Share of States in Additional Tax Devolution (₹ crore)

| State | Amount |

|---|---|

| Assam | 3,178 |

| Arunachal Pradesh | 1,785 |

| Meghalaya | 779 |

| Manipur | 727 |

| Tripura | 719 |

| Nagaland | 578 |

| Mizoram | 508 |

| Sikkim | 394 |

| Total NE States | 8,668 |

Major Allocations:

Uttar Pradesh – ₹18,227 crore; Bihar – ₹10,219 crore; Madhya Pradesh – ₹7,976 crore; West Bengal – ₹7,644 crore.

Concerns of Northeastern States

– Population-based formula disadvantage: Sparse populations under 2011 Census reduce allocation share.

– Infrastructural backwardness: Weak absorptive capacity limits fund use.

– Minimal share: Only 8.5% of total, despite strategic importance.

– Fiscal dependence: Up to 90% of state budgets rely on central funds.

– Seasonal delays: Fund release and utilisation bottlenecks delay projects.

– Climate & terrain constraints: High cost of infrastructure in hilly terrain reduces real value.

Way Forward

– Formula recalibration: 16th Finance Commission should account for regional equity, climate risk, and infrastructure gaps.

– Timely fund flow: Real-time digital monitoring to ensure transparent utilisation.

– Enhance state capacity: Build institutional strength for planning and capital project execution.

– Integration with PM Gati Shakti & NE Vision 2047: Link devolution to connectivity and energy priorities.

– Encourage own revenue: Reward states expanding tax base and improving administration.

Conclusion

The additional tax devolution underscores India’s cooperative fiscal federalism, supporting states to enhance infrastructure and welfare spending.

For the Northeast, it provides fiscal breathing space to bridge structural gaps.

However, achieving equity, efficiency, and autonomy in devolution remains essential for a self-reliant India.

UPSC Mains Practice Question

Q. Discuss the significance of tax devolution in promoting fiscal federalism in India. Critically examine the issues faced by Northeastern states in the context of the recent additional tax devolution and suggest measures to ensure equitable regional development. (250 words)

Share This Story, Choose Your Platform!

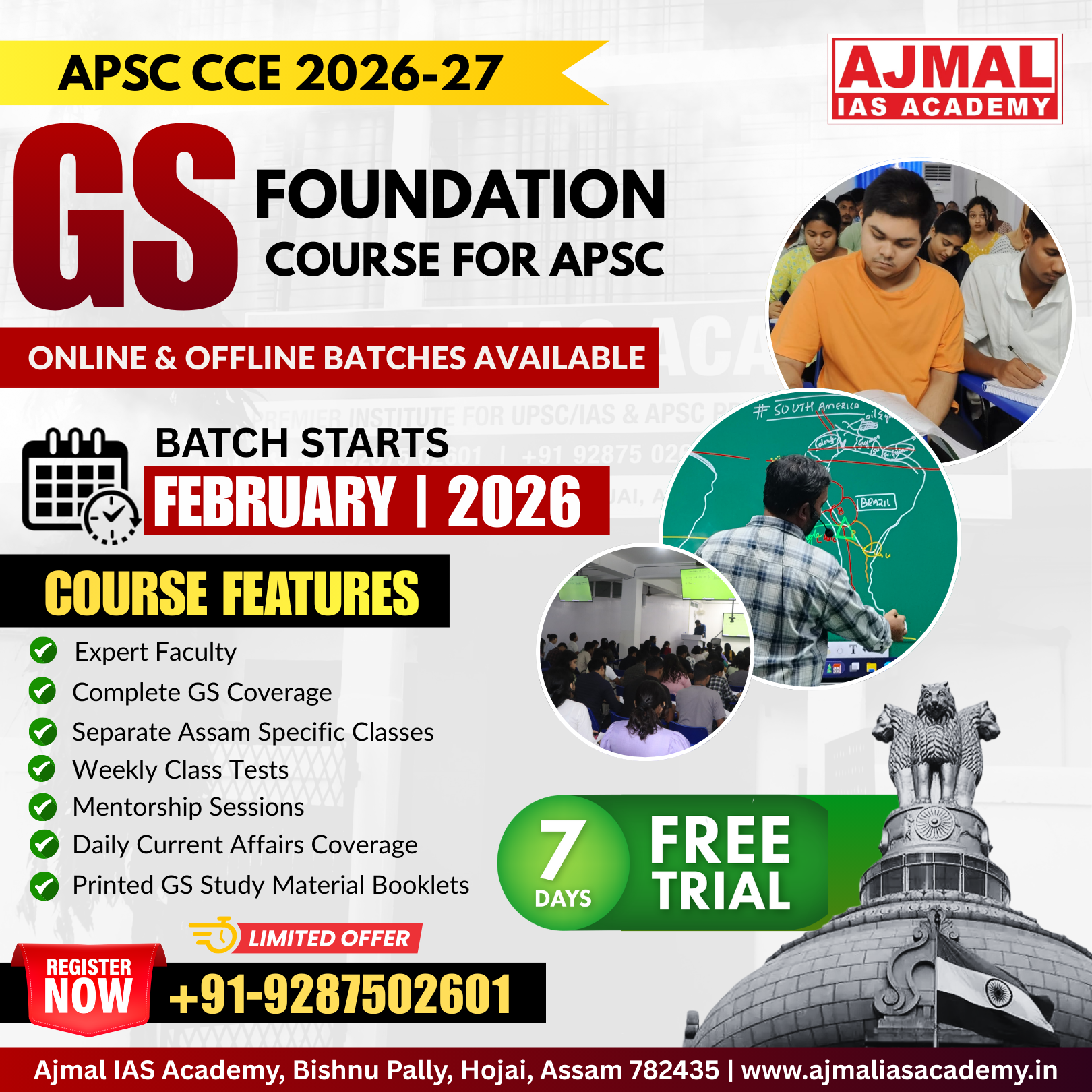

Start Yours at Ajmal IAS – with Mentorship StrategyDisciplineClarityResults that Drives Success

Your dream deserves this moment — begin it here.