Context

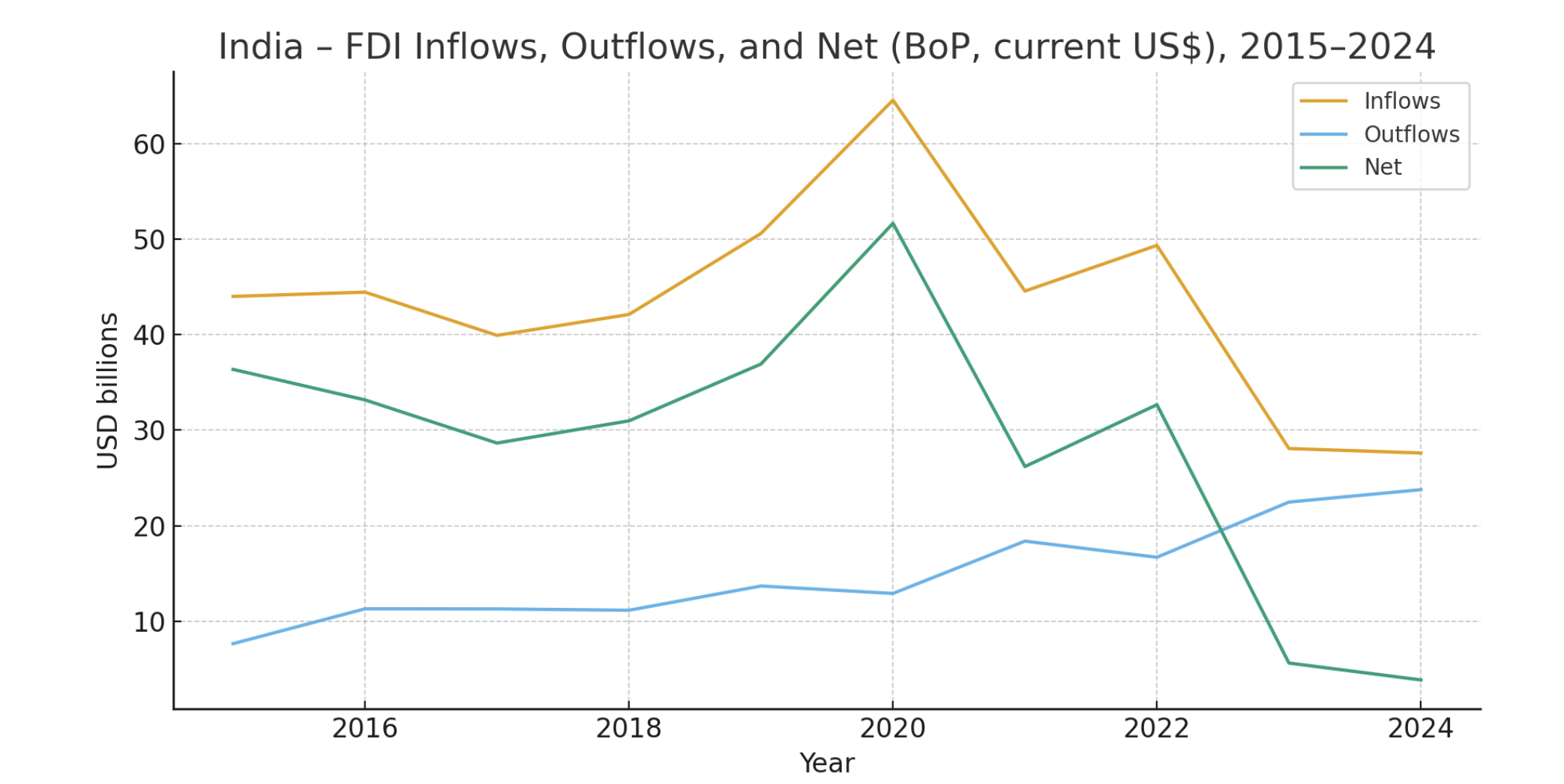

India’s gross foreign direct investment (all money coming in) was about USD 81 billion in FY 2024–25. But net foreign direct investment (after subtracting exits, profit repatriation, and outward investment by Indian firms) fell to about USD 0.4 billion. In May 2025, net foreign direct investment was only about USD 35 million.

- Why it matters: A big gap between inflows and outflows affects jobs, manufacturing, technology transfer, and external stability (current account and the currency).

Key concepts

- Foreign Direct Investment (FDI): Investment by a person or company located outside India into the equity of an Indian company (normally 10 percent or more in a listed company, or any equity in an unlisted company). India also counts reinvested earnings and other capital.

- Gross vs Net:

- Gross FDI: All money coming in (equity + reinvested earnings + other capital).

- Net FDI: Gross inflows minus (repatriation/divestment + outward investment by Indian firms).

- Entry routes: Automatic route (no prior approval for most sectors) and Government route (approval in sensitive sectors).

- Prohibited areas: Lottery, gambling/betting, chit funds, nidhi companies, and activities kept for the public sector such as atomic energy and railway operations.

Trend-line & Composition

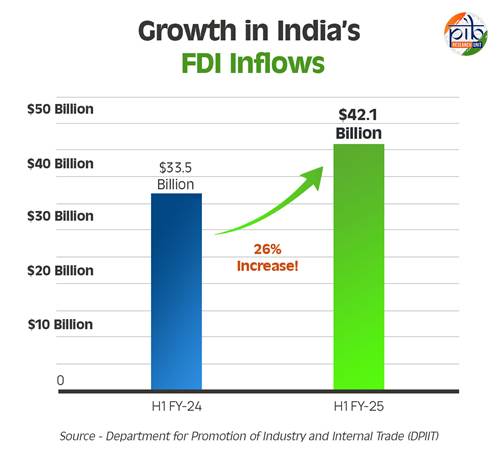

- Peak and swings: Annual inflows were around USD 84 billion in FY 2021–22, fell to about USD 71 billion in FY 2023–24, then recovered to about USD 81 billion in FY 2024–25 (provisional).

- Net retention is weak: Net foreign direct investment fell to about USD 0.4 billion in FY 2024–25 (from ~USD 10 billion a year earlier).

- Exits rose: Repatriation/divestment moved from ~USD 44.4 billion (FY 2023–24) to ~USD 51.4–51.5 billion (FY 2024–25).

- Sources: A large share comes from financial centres (for example, Singapore is roughly one-third of equity inflows).

- Sectors: Services are the largest recipient (about one-fifth), computer software and hardware next (about one-sixth). Authorities report higher manufacturing inflows by value (about USD 19 billion), but services still dominate the overall mix.

India’s FDI Trends, Last 10 years

Diagnosis (why inflows are up but net retention is down)

Global reasons

- Higher interest rates abroad, investors booking profits (including through public share sales), and supply chains being rebuilt closer to home markets.

India-specific reasons

- Higher repatriation/divestment as earlier investments mature and exit.

- Rising outward investment by Indian companies seeking stable rules, technology, market access, and lower cost of capital in developed markets.

- Domestic frictions—land access, logistics costs, power reliability, and contract enforcement—slow new greenfield factories.

- Policy note: More exits can signal a deeper, more liquid market (a positive), but the task is to retain and reinvest a larger share inside India.

Development & Macro Implications

- Jobs and “Make in India”: Low net retention weakens support for new plants, supplier ecosystems, and technology transfer.

- External stability: Foreign direct investment is “patient capital.” Lower net foreign direct investment reduces the cushion for the current account and can limit monetary policy room in shocks.

- Quality vs quantity: Greenfield manufacturing has a larger multiplier than asset trades or short-term deals.

Hidden weaknesses

- Headline totals can look strong even when divestment is high and outward investment is rising.

- Manufacturing’s share is still modest versus services, which may dilute long-term resilience.

- Heavy reliance on treaty hubs (for example, Singapore, Mauritius) shows that tax and routing motives still shape flows.

- If policy uncertainty or logistics gaps persist, investors may enter and exit rather than build and expand.

Reform Agenda (actionable steps)

- A) Target “sticky” capital in priority sectors

Electronics, semiconductors, auto components, renewable energy, defence, chemicals, medical devices, logistics parks. Offer time-bound approvals, stable tariff paths, and strong after-care for expansions. - B) Make exits normal—but convert them into local reinvestment

Smooth exits are fine. Aim to turn exits into re-entries: fast land and utility tie-ups, tax clarity on reinvested earnings, factory-level facilitation, and quick approvals for scaling. - C) Cut state-level friction

A single window that actually closes files, model land contracts/leases, time-bound power connections, logistics parks near ports, and digitised dispute resolution with published timelines. - D) Modern treaties and clear domestic rules

Upgrade bilateral investment treaties; ensure predictable data, competition, and e-commerce rules; keep security clearances transparent and time-bound in sensitive sectors. - E) Finance and skills

Long-tenor rupee and foreign-currency credit for anchor investors; polytechnic and apprenticeship pathways linked to industrial clusters. - F) Measure what matters (better dashboards)

Track and publish: greenfield share, manufacturing share, state-wise project timelines, reinvestment rates, reasons for outward investment, and time to utilities—not just top-line inflows.

Exam Toolkit (quick data + Mains Perspective)

Quick data bites

- Gross foreign direct investment FY 2024–25: ~USD 81 billion (provisional).

- Net foreign direct investment FY 2024–25: ~USD 0.4 billion (very low).

- May 2025 net foreign direct investment: ~USD 35 million.

- Repatriation/divestment FY 2024–25: ~USD 51.4–51.5 billion (record).

- Top source (equity share): Singapore (~one-third).

- Top sectors: Services, computer software and hardware; manufacturing inflow higher in value, but overall share still smaller than services.

Mains Q1 (250 words):

“India’s foreign direct investment story in FY 2024–25 shows strong gross inflows but record-low net retention. Explain this divergence with data. What reforms would shift the mix toward durable, job-creating investment?”

Hints: Define gross vs net; quote net near zero and high divestment; give global and India-specific reasons; stress jobs/tech transfer/current account; list reforms—sticky greenfield in priority sectors, state-level single window with timelines, modern treaties, long-tenor finance and skills, strong after-care, and measurement of reinvestment/greenfield share.

Mains Q2 (250 words):

“Quality over quantity should guide India’s foreign direct investment policy. Discuss with reference to sectoral composition, sources of inflows, and the role of reinvestment.”

Hints: Contrast services-heavy mix with manufacturing multipliers; note reliance on treaty hubs; argue for corridor-ready manufacturing (electronics, semiconductors, auto components, renewables); explain why reinvestment and supplier ecosystems matter; propose stable tariffs, time-bound approvals, and better state-level execution.

One-line wrap: The real success is not “foreign direct investment that arrives,” but “foreign direct investment that stays, expands, and builds India’s factories, skills, and supply chains.”

Share This Story, Choose Your Platform!

Start Yours at Ajmal IAS – with Mentorship StrategyDisciplineClarityResults that Drives Success

Your dream deserves this moment — begin it here.