Relevance: International Trade, External Sector (GS-3) • Source: The Hindu; United Nations Comtrade

The United States has announced fresh tariffs on Indian rice, alleging “dumping.” This comes amid ongoing trade negotiations and existing 50% tariffs on several Indian goods.

Impact of Tariffs on Both Nations

- Impact on India: Minimal—only 3.3% of India’s rice exports go to the U.S., making it a minor market.

- Impact on U.S.: Significant—India supplies 26% of U.S. rice imports, so tariffs could raise domestic prices and hurt American consumers and food processors.

What are Tariffs?

Tariffs function as border taxes imposed by a government on imported goods to protect domestic industry or address alleged dumping.

Q. In the context of international trade, consider the following statements about dumping:

- Dumping occurs when a product is exported at a price lower than its normal value, which may be the domestic price or the cost of production.

- Anti-dumping duties can be imposed under World Trade Organization rules only after a country proves material injury to its domestic industry.

- All forms of dumping of agricultural commodities are automatically prohibited under the Agreement on Agriculture.

Select the correct answer:

A. 1 and 2 only

B. 2 only

C. 1 and 3 only

D. 1, 2 and 3

Share This Story, Choose Your Platform!

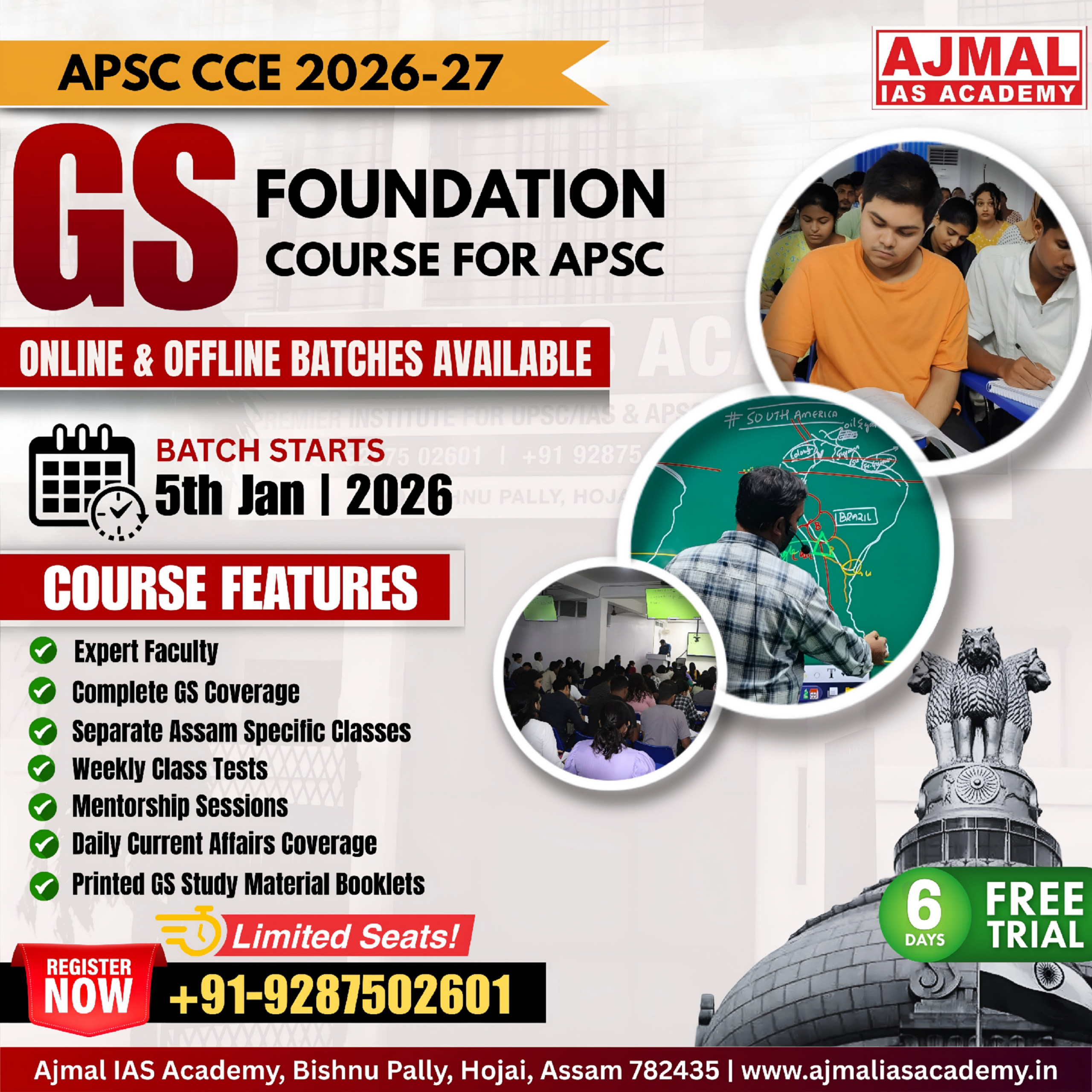

Start Yours at Ajmal IAS – with Mentorship StrategyDisciplineClarityResults that Drives Success

Your dream deserves this moment — begin it here.